Product Design

Agricultural

machinery

financing

Reducing credit analysis time and making life easier for banking correspondents

The project

Brazil is one of the largest grain producers in the world, so the demand for new businesses and new investments grows every year. For 2024/2025 there is a projection of approximately 36 billion reais in financing for agricultural machinery and equipment alone. This scenario tends to grow every year with the accelerated pace of production and the increase in the level of grain exports.

The objective of this project was to accelerate the credit analysis process for customers who wish to finance large equipment for farms and plantations.

The process of purchasing an agricultural machine or large equipment takes approximately 30 days to approve and evaluate all necessary documents.

With this solution, the bank can speed up the process by up to 20 days, enabling new business more efficiently.

The challenge

The main challenge for the large vehicle sales segment is credit competition from other banks offering lower rates and more competitive contracting advantages. In this segment, time is crucial to close new deals.

During the project, the challenge was to understand all the nuances of the business and design a solution that served banking correspondents with greater agility and effectiveness.

Steps

1 – Empathy with stakeholders and users

2 – Definition (users, objectives, needs and pains)

3 – Ideation

4 – Prototyping

During the process of immersion in the topic, interviews were carried out with users to understand the complexity of the context of selling agricultural machinery and the entire process of validating and evaluating purchasing capacity and approving the steps necessary to acquire the asset.

Several activities were carried out to establish a connection with the topic and the complexity of the banking ecosystem.

Ideaton

During the co-creation sessions the main objectives were:

– Align knowledge about the market and the existing scenario,

– Map the desirable scenario

– Establish product definitions (vision and objectives)

– Prototype

– Prioritization of features

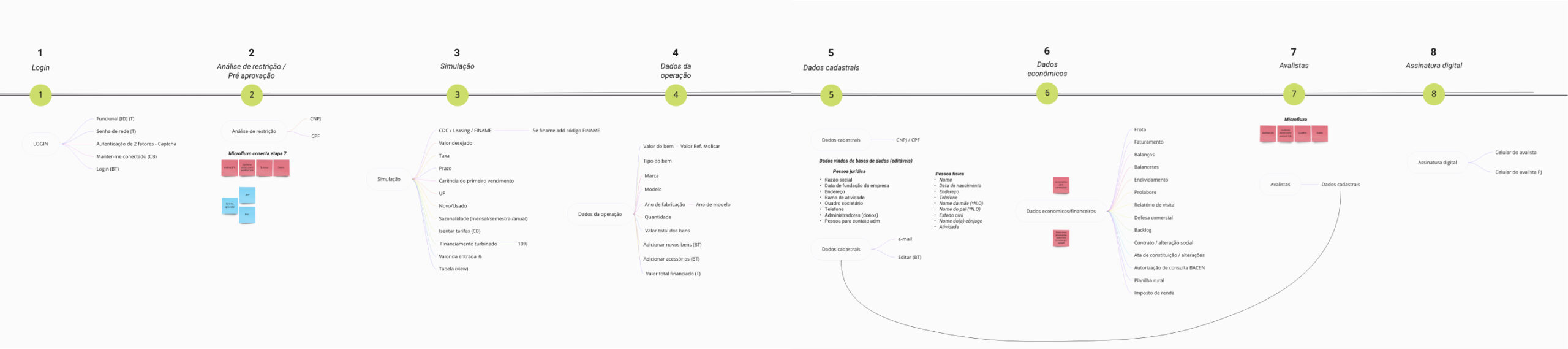

One of the most important moments of the process was the stage of mapping the journey, understanding all the necessary steps from registering a new customer to releasing credit in the user’s account.

In this process, the number of completed fields and the number of separate systems to obtain information necessary to complete the registration and evaluation of the financial statement were considered.

The process was extremely complex and full of steps that made the entire process very slow and time-consuming.

Journey mapping numbers:

Prototype

Results

All Design processes applied to the project were able to help establish a new solution design considering user experience, technology and business.

Considering the construction of a new system with integrations via API and third-party services, it will be possible to establish an experience with the following performance indicators.

64% fewer fields to fill in during the credit contracting simulation

100% systems to open during the simulation process. All systems and APIs will be integrated

64% fewer clicks during the journey