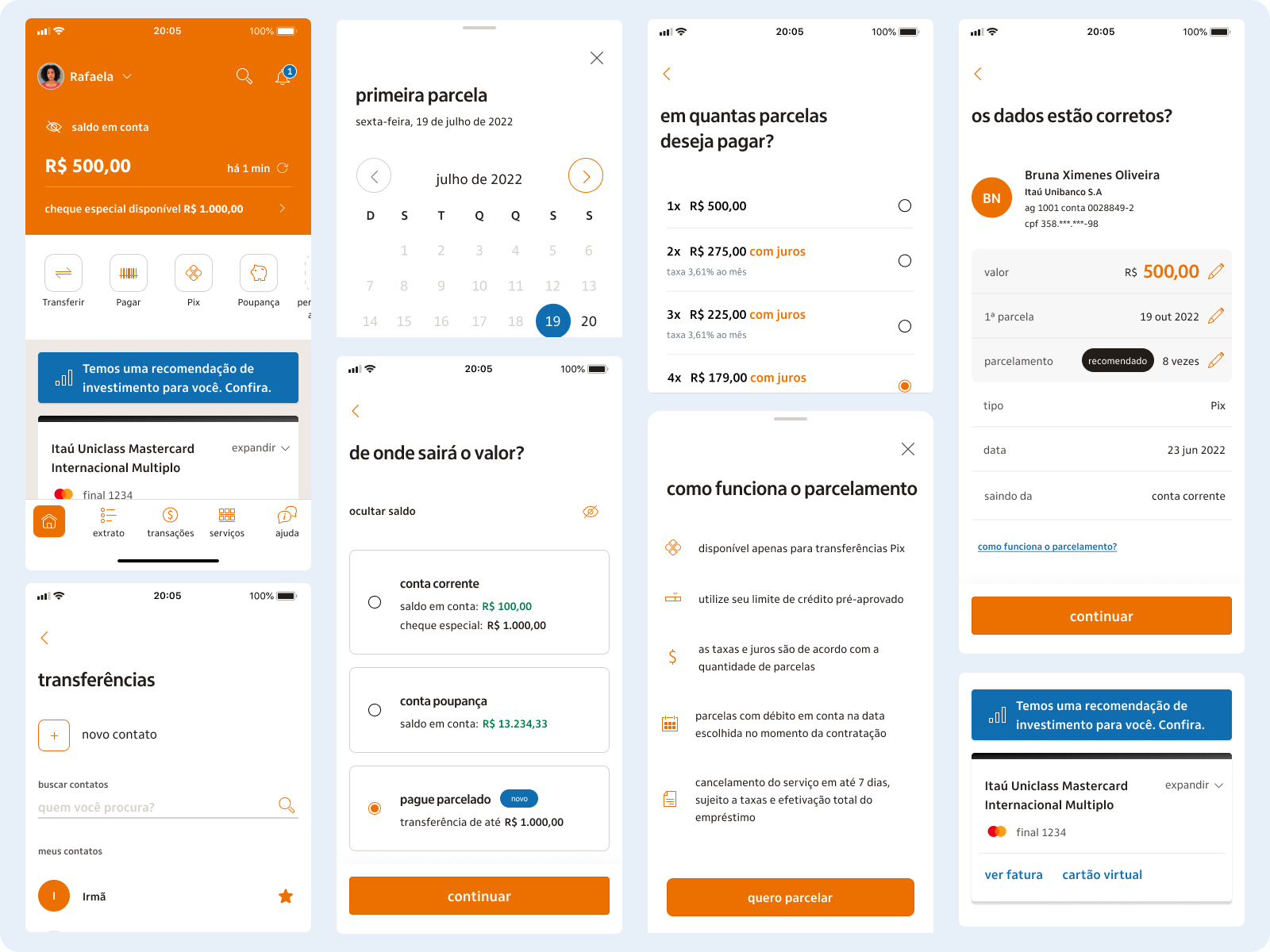

Product Design

Uncomplicated

micro credit

for transfers via Pix

Promoting agility in contracting credit for emergency transfers without bureaucracy

The project

Payments via Pix are the most used among Brazilians, the method of payment and transfers between accounts has become popular and is practically the main method used in Brazil due to its ease and speed in receiving the amounts paid, which are debited from the account instantly.

The objective of this project was to make it possible to carry out Pix transactions with a positive balance for loans. Basically, the person has the advantage of borrowing an amount to carry out the transaction without the bureaucracy of approval from the account manager.

Composition of project stages

– Benchmark

– Co-creation workshop

– Usability testing

– Accessibility specifications

The challenge

The big challenge of this project was to guarantee the practicality of transfers via Pix using technologies integrated with credit limit products.To solve this challenge, a study was carried out to minimize performance impacts every time the credit limit APIs were consulted, providing a response regarding the condition of new installments or even the best payment date.Every time the user changes the payment due date, the API is consulted again to ensure that that date is valid for the bank’s loan program.